FAQs

To complete an electronic Free Application for Federal Student Aid (FAFSA®) simply go to https://studentaid.gov/. You can complete your FAFSA® anytime after October 1.

The FAFSA® will determine your eligibility for all Title IV Aid (Federal Pell Grant, Federal SEOG Grant, Federal Stafford Student Loans and Federal Work Study). Not all aid is based on need. Consequently, everyone can be eligible for some type of loan.

FAFSA® Deadlines: October 1 is the first day a student can submit a FAFSA® application for the following academic year.

Manhattan Tech's priority deadline is July 1st. However, you should complete your FAFSA® well in advance of the semester you wish to attend as there may be additional paperwork to complete.

In order to receive a book voucher for the fall semester, you must have all your financial aid paperwork turned in no later than July 1st. If eligible, text book vouchers allow you to charge your textbooks purchased at the eCampus Bookstore against your expected financial aid.

Before you and your contributors start to fill out your online Free Application for Federal Student Aid (FAFSA®) form, you’ll each need to create a StudentAid.gov account so that you can complete your required sections of the form and be eligible for federal student aid.

You’ll access your StudentAid.gov account using an FSA ID (account username and password). Your StudentAid.gov account contains verified personal information, so each StudentAid.gov account can link to only one person. Don’t wait. Take the first step to completing your FAFSA form today and create a StudentAid.gov account.

Create your StudentAid.gov account at https://studentaid.gov/fsa-id/create-account/launch

Providing consent and approval on the Free Application for Federal Student Aid (FAFSA®) form is a requirement for federal student aid eligibility. When you and your contributors provide consent and approval on the FAFSA® form, you agree to

- share your personally identifiable information provided on the form with the IRS,

- have your federal tax information transferred directly into the form,

- allow the U.S. Department of Education (ED) to use the information to determine your eligibility for federal student aid,

- allow ED to share your federal tax information with schools and state higher education agencies, and

- allow ED to reuse federal tax information on other FAFSA® forms you’re invited to.

In order to supply a student's FAFSA information to an institution, please include our six-digit number called a Title IV Institution Code or Federal School Code. The school code for Manhattan Tech is 005500.

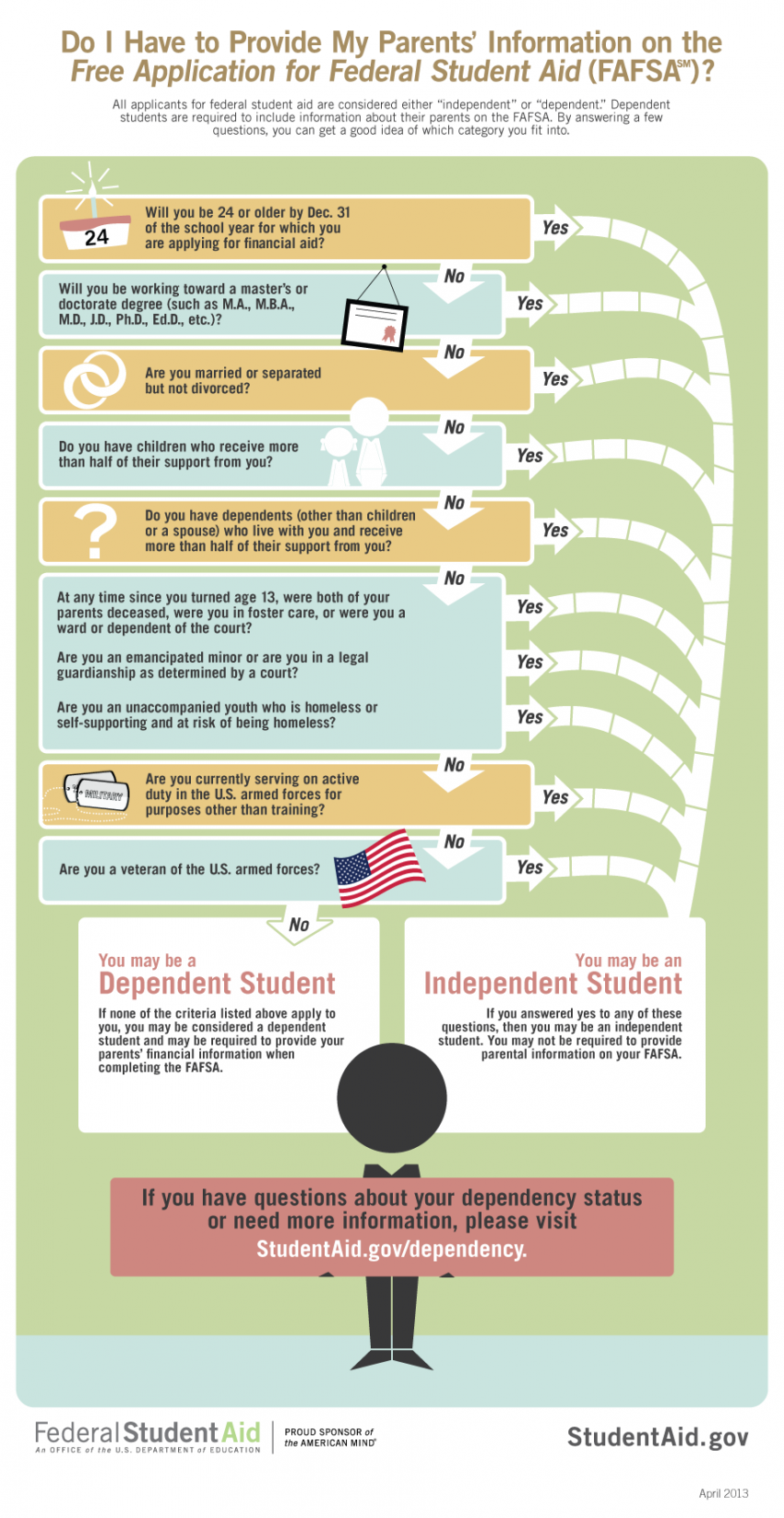

The Higher Education Act of 1992 states which students will be considered independent of parental support for education costs. Independent students must be able to document at least one of the following criteria:

The Higher Education Act of 1992 states which students will be considered independent of parental support for education costs. Independent students must be able to document at least one of the following criteria:

- 24 years old by Dec. 31 of the award year

- Orphan or ward of the court

- Veteran of the Armed Forces of the U.S.A.

- Enrolled in a graduate or professional program (beyond a bachelor's degree)

- Married

- Student has legal dependents other than spouse

If you do not qualify under these rules, the financial aid administrator or Financial Assistance Committee may consider exceptional circumstances that would allow you to be independent. The unwillingness of a parent to provide support or the choice of a student not to accept support are unacceptable reasons to be considered independent. If you have exceptional circumstances, contact the Manhattan Tech Office of Financial Aid. You may also be required to complete an Independent Appeal Form and turn in the required documentation.

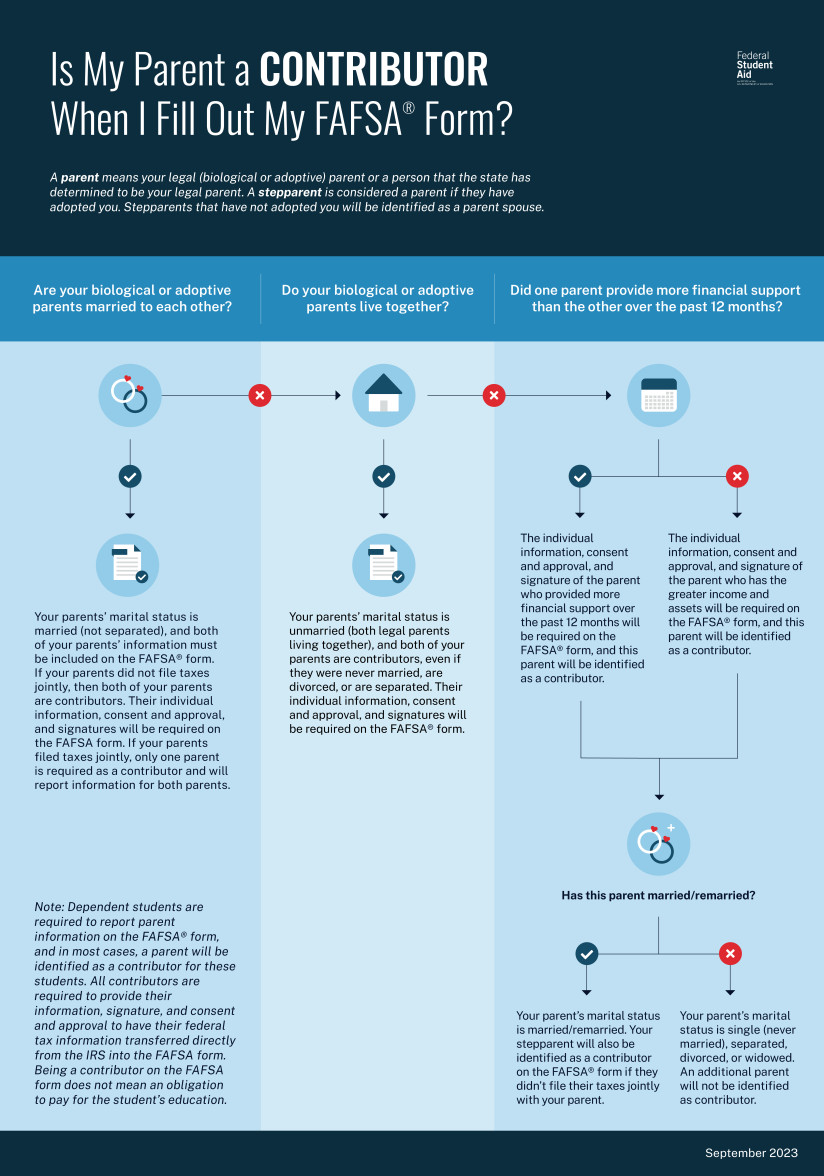

Click here to view Parent Information on the Federal Student Aid website.

Parent information is required when completing and submitting the 2024–25 Free Application for Federal Student Aid (FAFSA®) form if you’re considered a dependent student. If your parents are divorced or separated, which parent’s information will be required is determined by whether your parents live together or not and which parent provided the most financial support.

It’s important to complete the Free Application for Federal Student Aid (FAFSA®) form to be eligible for federal student aid even if your parent is not a U.S. citizen. Your parent’s citizenship status will not affect your eligibility for federal student aid, but if you’re a dependent student, their information will be required on the FAFSA® form. If your parent is identified as a contributor, they will need to create their own StudentAid.gov account to access your form. After they provide their information, their consent and approval to transfer federal tax information, and a signature, you’ll be able to complete and submit your FAFSA® form.

To complete the Free Application for Federal Student Aid (FAFSA®) form, you will need a StudentAid.gov account. Starting in December 2023, you will be able to create a StudentAid.gov account even if you don’t have a Social Security number (SSN). To do so, you’ll follow the prompts on-screen to enter your information and select the “I don’t have a Social Security number” checkbox. Accounts created without an SSN have limited functionality. The only people who should create an account without an SSN are a student’s parent or spouse who doesn’t have an SSN or a student who’s a citizen of the Freely Associated States and needs to complete the FAFSA® form online. You must have an SSN or be a citizen of the Freely Associated States to be eligible to receive federal student aid. More: https://studentaid.gov/announcements-events/fafsa-support

The Federal Government selects applications for verification as they are submitted. It is then the school's responsibility to request copies of tax return transcripts and other information to verify that the data reported on the Free Application for Federal Student Aid (FAFSA®) is accurate. Errors must be corrected and sent to the Federal Processor. Eligibility for financial aid can change due to verification.

Please note that if the tax information for a student, and parent, if required, is added via the IRS Direct Data Exchange (DDX) when filling out the FAFSA®, they may not be required to turn in additional tax documentation. Students, and parents, if required, may go back into the FAFSA® to make corrections.

Cost of Attendance (COA) is the estimated amount it will cost a student to go to school. COA can vary widely between institutions and individual students. The following items are included in the COA at Manhattan Tech for students attending school at least half time:

- tuition and fees;

- books, course materials, supplies, and equipment;

- cost of housing and food (or living expenses);

- transportation expenses;

- loan fees;

- miscellaneous expenses;

- allowance for childcare or other dependent care;

- costs related to a disability; and

- costs of obtaining a license, certification, or a first professional credential.

Please note that these expenses are not all paid directly to Manhattan Tech but are expenses students might incur while pursuing their education.

Expenses associated with attending college are not tailored to individual expenses but reflect an average paid by Manhattan Tech students in a particular program.

The Student Aid Index (SAI) is an eligibility index number that our financial aid office uses to determine how much federal student aid you would receive if you attended the school.

This number results from the financial information you and your contributor(s) provide on your FAFSA® form.

This number is not a dollar amount of aid eligibility or what your family is expected to provide. A negative SAI indicates the student has a higher financial need. Learn how the SAI is calculated.

The college will determine your financial need by subtracting your SAI from the cost of attendance. Learn more about how financial aid is calculated.

If your FAFSA® form is complete and fully processed, your estimated federal student aid and SAI will display under the “Eligibility Overview” tab of your online FAFSA® Submission Summary. Before completing the FAFSA® form, use the Federal Student Aid Estimator to estimate your SAI.

Unfortunately, family or personal circumstances can take a turn for the worse during an award year. The federal government allows each school to develop a policy of Professional Judgment to review unforeseen circumstances that limit a student or family's ability to pay for college expenses. For special circumstances to be considered, please discuss the issue with the Office of Financial Aid.

After you submit your FAFSA®, the federal processor performs an initial eligibility check and calculates need levels based on the information provided. You will receive confirmation in the form of an email with instructions on how to access a copy of your FAFSA® Submission Summary from the federal processor and your information will be forwarded to the Manhattan Tech Office of Financial Aid electronically for additional eligibility checks. The Office of Financial Aid will contact you for further information.

According to federal regulations, Student Aid Index (SAI) is subtracted from the allowable Cost of Attendance (COA) to determine financial need. This determines how much need-based aid you may qualify for. To determine how much non-need based aid you can receive, Manhattan Tech takes your COA and subtracts any financial aid you've already been awarded. It is the policy of the Manhattan Tech Office of Financial Aid to award students their maximum eligibility in all available fund categories.

Because every student's situation is different, processing time will vary. A few of the factors that can impact processing time are: whether or not a student is selected for verification, how quickly all requested documents are submitted to the Office of Financial Aid, and when the FAFSA® was originally submitted. Manhattan Tech typically starts processing applications for the upcoming award year by the end of March and applications will be processed in the order in which they were received. Generally, once you submit your FAFSA® it will take 1-2 weeks for it to be processed and forwarded to Manhattan Tech. The Office of Financial Aid will then contact you by email requesting any additional information needed. Once all documents are submitted to the Office of Financial Aid, please allow 4-6 weeks processing time, particularly during June through August. Although the Office of Financial Aid will work to keep in touch with you, it is your responsibility to make sure all documents are submitted in a timely manner and that your file is both accurate and complete. Communications are made primarily by official Manhattan Tech email or the Manhattan Tech Financial Aid Portal.

Students must be enrolled at least half-time, 6 credits to be eligible for Direct Loans. Financial aid can vary depending on enrollment status. At Manhattan Tech 6 - 8 credits is ½ time, 9 - 11 credits is ¾ time and 12 or more is full-time.

All scholarships and outside funding must be deducted from your Cost of Attendance (COA), a combination of your direct billed costs (Manhattan Tech tuition & fees) and indirect expenses (transportation, housing, and personal expenses), based on your enrollment, program, and living situation. Generally, a student may not receive aid in excess of their COA. If your scholarships/outside funding for the academic year exceeds your Cost of Attendance, the amount of student loan you qualify for may decrease.

Aid cannot be disbursed until all required documents have been submitted and you officially enroll in the number of hours for which aid was processed. Generally, funds are disbursed on or after the 20th day of class. Financial aid will first pay off any outstanding tuition and fee charges. Refunds of aid exceeding charges are mailed by check to the student's address of record or electronically through direct deposit.

No, only the information used to determine eligibility transfers to another school. The student must go to https://studentaid.gov and correct their processed FAFSA®. The correction is adding the Title IV code for the school you are transferring to. Once the correction is made, the school added will electronically receive the results of your FAFSA® and will determine your eligibility for their institution.

Sometimes situations arise that cause students to be enrolled at more than one institution at a time. However, you cannot receive financial aid from both institutions. The school you plan to receive a certificate/degree from should be the school you receive financial aid from and is considered the 'home' institution. The home institution can determine your financial aid eligibility, award aid based on the hours enrolled that contribute toward your certificate/degree, and disburse financial to you. If you are enrolled in classes that are not on the Manhattan Tech campus, you need to provide Manhattan Tech Office of Financial Aid with proof of enrollment of those hours. Students may be required to make payment to the 'host' institution for tuition and fees prior to the financial aid disbursement date at Manhattan Tech. Please speak with the business office at the other institution for their policies.

Definitions of common terms can be found at the Federal Student Aid website.

Manhattan Area Technical College typically cannot administer financial aid to non-degree-seeking students. Federal regulations require you are enrolled in an eligible academic program for the purpose of obtaining a degree, in order to qualify for federal aid.